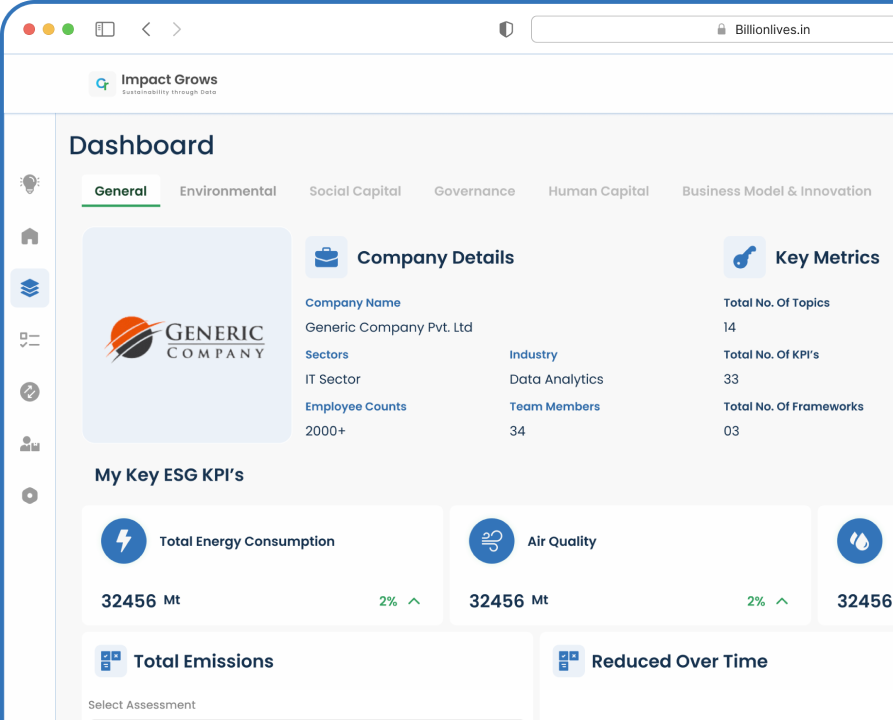

BillionLives Business Initiatives Private Limited is hereinafter

referred to as (“We”, “Our” or “Us”) and the terms “You/ Your” and

“User” refer to you as a Customer of the “Impact Grows” product

(“Product”) wherever the context so requires.

AGREEMENT

By logging on to our Product it shall be presumed that You have

read these Terms of Service (“Agreement”) and have unconditionally

accepted the same. Please note that this constitutes a binding and

enforceable agreement between You and Us. This Agreement does not

alter in any way the terms or conditions of any other written

agreement You may have with Us for other services.

REGISTRATION AND INFORMATION OF THE USER

You are required to register and create a profile to be eligible

to access the Product. You are solely responsible for maintaining

the secrecy and confidentiality of your login details including

your username, password and user code. You hereby acknowledge and

accept that the Product will grant access to any person who has

obtained your username, and password in the same manner as it

would have granted access to You and You shall be responsible for

all activities conducted under your username, password and any

user code. We shall not be responsible in any manner for any

losses occurring from any breach of secrecy of your username, or

password.

By entering into this Agreement, You acknowledge that the Product

provided by Us is for your exclusive use only. Use or sharing of

Your user name and password by another user is prohibited. Failure

to comply will result in immediate suspension of Your account. You

agree to provide true, accurate, up-to-date and complete

information while registering for the Product. You are prohibited

from misrepresenting Your identity and agree not to represent

Yourself as another user or login/ register using the identity of

any other person. If You provide any information that is untrue,

inaccurate, not current or incomplete or We have reasonable

grounds to believe that such information is untrue, inaccurate,

not current or incomplete, or not following this Agreement We

reserve the right to indefinitely suspend or terminate or block

Your use or access to the Service in any manner whatsoever.

Please note that the personal information provided by You for

Product is governed by GCE Privacy Policy. Your election to use

the Product indicates your acceptance of the terms of the GCE

Privacy Policy.

DATA OWNERSHIP

We respect Your right to ownership of content created or stored by

You. You own the content created or stored by You. Unless

specifically permitted by You, Your use of the Product does not

grant Us the license to use, reproduce, adapt, modify, publish or

distribute the content created by You or stored in Your user

account for commercial, marketing or any similar purpose. But You

grant Us permission to access, copy, distribute, store, transmit,

reformat, publicly display and publicly perform the content of

Your user account solely as required for the purpose of providing

the Service to You.

OUR INTELLECTUAL PROPERTY RIGHTS

You acknowledge that We own all rights, title and interest in and

to the Product and the Website, including all Intellectual

Property Rights therein (the "Our Rights"). Our Rights are

protected by applicable intellectual property laws. Accordingly,

You agree that You will not copy, reproduce, alter, modify, or

create derivative works from the Product offered by Us.

"Intellectual Property Rights" includes the following (wherever

and whenever arising and for the full term of each of them,

whether registrable or not), any patent, trade mark, trade name,

service mark, service name, design, design right, copyright,

database right, moral rights, technical know-how, trade secret and

other confidential information, rights like any of these items in

any country, rights like unfair competition rights and rights to

sue for passing off or other similar intellectual or commercial

rights (in each case whether or not registered) and registrations

of and applications to register any of them. The intellectual

property right created upon the Service by You shall be owned by

You.

The intellectual property right created upon the Service by You

shall be owned by You.

OUR LIABILITY

In no event shall We shall be liable for any direct, indirect,

incidental, special, consequential or exemplary damages, including

but not limited to, damages for loss of profits, goodwill, use,

data or other intangible losses arising (in any manner whatsoever)

out of or in connection with the Service. In no event, does our

entire liability to you in respect of any service, whether direct

or indirect, exceed the fees paid by you towards the Service.

INDEMNIFICATION

You shall indemnify and hold harmless the BillionLives and its

officers, directors, agents, and employees, from and against any

losses, liabilities, actions, suits, claims, proceedings, costs,

damages, judgments, amounts paid in settlement and expenses

(including without limitation attorneys' fees and disbursements),

made by any third party or penalty imposed due to or arising out

of Your breach of this Agreement and BillionLives Privacy Policy

incorporated herein by reference, or Your violation of any

applicable Law, rules or regulations or the rights of a third

party or resulting from untrue, inaccurate, not current or

incomplete information provided or verified by You.

GOVERNING LAW AND ARBITRATION

Any claim, differences or dispute arising under or in connection

with or in relation hereto this Agreement and BillionLives Privacy

Policy shall be governed by the applicable laws in force in India.

Any dispute, difference or controversy of whatever nature and

howsoever arising under or out of or concerning this Agreement

and/or BillionLives Privacy Policy (including its interpretation)

between the parties, and so notified in writing (the ‘Dispute’)

shall be referred to President-Arbitration Centre- Kerala for

Arbitration. The Arbitration shall be conducted by a Sole

Arbitrator appointed by the ‘President-Arbitration Centre- Kerala’

as per Arbitration and Conciliation Act, 1996 as amended from time

to time. The venue of the Arbitration shall be Kochi and it shall

be conducted in the English language. The arbitration award shall

be final and binding on the parties. In any case, for supervisory,

injunctive relief or relief of specific performance, this

Agreement and the BillionLives Privacy Policy and any Dispute

shall be subject to the exclusive jurisdiction of courts in the

city of Kochi, India.

NOTICE

All notices to Us shall be served by email or registered post

acknowledgement. Any notice provided to the Us according to this

Agreement should be sent to Our address as mentioned on our

Website

WAIVER

Any failure by the Us to enforce or exercise any provision of this

Agreement and Privacy Policy, or any related right, shall not

constitute a waiver by the Us of that provision or right.

SEVERABILITY

If for any reason, a court of competent jurisdiction finds any

provision of this Agreement, or portion thereof, to be

unenforceable, that provision shall be enforced to the maximum

extent permissible to give effect to the intent of the parties as

reflected by that provision, and the remainder of the Terms and

Conditions shall continue in full force and effect

.png)

.png)